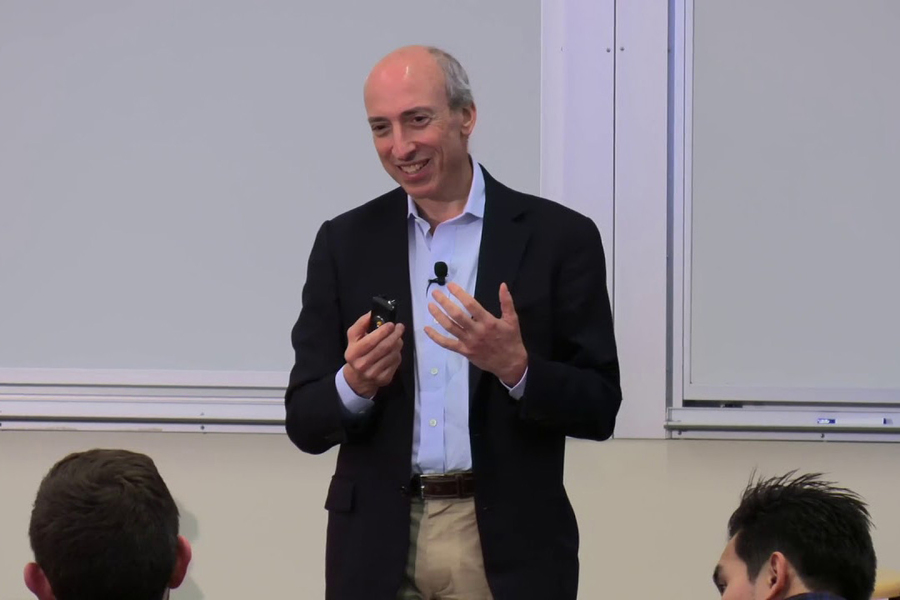

Gary Gensler, a leading finance expert and a faculty member at the MIT Sloan School of Management, has been picked by President-elect Joe Biden as his nominee to be chair of the U.S. Securities and Exchange Commission (SEC).

Gensler is a veteran of both public service and the private sector, and has been a proponent of reform and transparency in financial markets. He is perhaps best known for his influential tenure as chair of the Commodity Futures Trading Commission (CFTC) during the Obama administration, from 2009 to 2014.

As CFTC head, Gensler recommended greater oversight of the financial derivatives market, which was a central element in the banking-sector crisis that emerged in 2007. Gensler also helped implement the Dodd-Frank banking reform bill, passed by the U.S. Congress in 2010, which overhauled derivatives trading.

Under Gensler, the CFTC also brought charges against five financial institutions that it claimed had been manipulating the London Inter-Bank Offered Rate (LIBOR), a benchmark interest rate used globally. That action resulted in over $1.7 billion in corporate penalties.

The SEC is the leading finance-sector regulator in the U.S. It is intended to supervise securities markets, protect investors, and oversee financial-services firms, among other tasks.

Gensler’s nomination is subject to confirmation by the U.S. Senate.

A highly successful investment banker at Goldman Sachs for nearly two decades, Gensler moved into public service in the late 1990s. He served in the U.S. Treasury Department as Assistant Secretary for Financial Institutions from 1997 to 1999, and as Undersecretary for Domestic Finance from 1999 to 2001.

Gensler also served as a senior advisor to Sen. Paul Sarbanes, chair of the Senate Banking Committee, during the development of the Sarbanes-Oxley Act, passed in 2002. Enacted in the wake of a series of corporate scandals, that legislation revamped many corporate governance and accounting practices.

At MIT, Gensler has been professor of the practice of global economics and management, at MIT Sloan; co-director of MIT’s Fintech@CSAIL program; and a senior advisor to the MIT Media Lab Digital Currency Initiative. He has taught classes about blockchain, digital currencies, and other financial technologies, and won the MIT Sloan Outstanding Teacher Award for the 2018-19 academic year. Gensler first joined the Institute in 2018.

Along with Gregory Baer, Gensler is co-author of “The Great Mutual Fund Trap,” a 2002 book asserting, among other things, that actively managed mutual funds with higher fees generally perform worse than “passive” low-fee index funds.

Gensler began his career by working for Goldman Sachs from 1979 through 1997. At various points in his time there, he became a partner in the firm’s mergers and acquisition department; headed its media group; led fixed income and currency trading in Asia, and ultimately became co-head of finance at Goldman Sachs.

Gensler earned a BA in economics in 1978 and an MBA in 1979, both from the Wharton School of the University of Pennsylvania.