Around the world, more and more people are moving to cities. The increase in urbanization is paralleled by revolutionary advances in digital technology, innovation in the built environment, and new modes for how real estate is transacted and conducted. This combination has created significant opportunities — as well as challenges — for the global real estate industry. The MIT Center for Real Estate (CRE) will host its annual World Real Estate Forum on May 18-19, bringing together MIT faculty and researchers and industry thought leaders from more than 20 countries. This year’s agenda will delve deeply into issues related to the intersection of innovation and urbanization and their implications for cities and real estate markets worldwide.

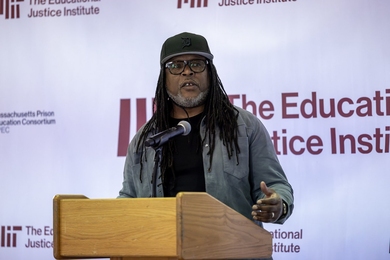

Albert Saiz is the director of CRE and the Daniel Rose Associate Professor of Urban Economics and Real Estate. He also leads the MIT Urban Economics Lab, which studies real estate economics, urban economics, housing markets, local public finance, zoning regulations, global real estate, and demographic trends affecting urban and real estate development. The School of Architecture and Planning recently asked Saiz to share his insights into developing trends around the world in the built environment, housing, and commercial real estate, and where global capital is likely to be deployed in the near future.

Q: With the trend toward urbanization, what kinds of innovative approaches to housing are being developed to meet the increasing demand in cities?

A: Quite frankly, I think a lot of what is going on is business as usual. If you look at China or some of the other developing economies that are growing — Vietnam, Indonesia, Malaysia — you see the same models of development, ones that are based on very large multifamily buildings that are built in isolation and separated by parks or roads, instead of adjacent buildings in high- density areas such as you find in Europe or Boston. The lack of contiguity is not good because it generates sprawl and is based on car usage, which is increasing in those developing economies.

On the positive side, we can talk about 3-D printing construction and stackable units, but what is actually more exciting is the very low hanging fruit — innovations that are sort of mundane but can really reduce construction costs, such as building more concrete factories in sub-Saharan Africa. I very much like the ideas of Chilean architect Alejandro Aravena and his firm Elemental. He constructs “incremental housing,” where half of a house and just the shell for the other half is constructed using government funds. As the families who move into these houses save money, they can progressively build out the other, incomplete half of the house using sweat equity.

Because we have to house so many new people worldwide, especially at the low end, a lot of the advancements are going to be geared toward producing housing typologies that are cheap, versatile, and customizable. I like the Skanska-Ikea model, called BoKlok, which uses Skanska’s construction expertise with a typical Ikea interior design to produce pre-designed homes. It’s a very streamlined industrial process aimed at minimizing construction costs.

We are also watching innovation in microunits, modular housing, new construction materials, and a lot of advancements in architectural modeling and Building Information Modeling, or BIM. Many of these things are going to crystallize globally for use in the lower to middle end of the market.

Q: What are some of the trends that are happening globally in terms of commercial real estate development?

A: In terms of industrial real estate, the innovation is going to be in new logistics facilities. We’re seeing a revolution in the way that people do logistics — more automatization, more multifunctional spaces that can adapt to different users, and a much greater need for flexibility. I also think you’re going to see more fabrication space, with small, local factories focused on design or products that can be pre-printed — because 3-D printers are going to be so much better in 20 years. We’re going to have a lot of production by small artisans, with increasing customization, and it’s going to bring more production back to the cities. This trend will be amplified by growing consumer demand for things that are organic, environmentally sensible, and produced locally, not shipped 10,000 kilometers using fossil fuels.

The other trend that is emerging is the repurposing of existing buildings for other uses. For instance, industrial space around the world is now being transformed into technology space in places like London, Barcelona, Turin, Glasgow, and the U.S. We’re going to see more flexible use of space, where a retail space might become an internet app lab after a few years, and then 10 years later, may take a different use.

Many cities now have central amenity districts, areas that are devoted to the live, work, and play concept. You see it not only in Europe but in places like Oklahoma City, where a real vibrancy is provided by this type of infill redevelopment. These developments are often very expensive, with a lot of public use, so we’re going to see an increase in public-private partnerships.

Q: The past few years have seen a significant influx of capital entering the U.S. commercial real estate market. Looking ahead, where else is capital likely to be deployed?

A: Some of the trends depend on what’s going to happen with China and other countries with current account surplus or with economic and political instability. Although China’s economy is still growing quite fast, it is decelerating. If it slows any more, or stops, there could be a slight correction in the pricing of commercial real estate assets. I certainly think the U.S. is still very attractive for real estate investment, and we’re seeing the appreciation of the dollar.

I think foreign investors are not being as cautious about the current U.S. administration as we may have expected. Despite the current administration’s “America first” rhetoric, Donald Trump’s businesses have partially been based on investing abroad and on using foreign capital. Trump’s policies are therefore unlikely to hurt the interests of major global real estate investors. In parallel, a healthy appetite for core assets from global investors is driving down yields in major cities around the world, and not only in the U.S. We’re still the safe, stable refuge for capital, despite the relatively low yields, and there is growing appetite for U.S. secondary markets.

There is also an interesting phenomenon occurring recently in China. China has been tightening the outflows of capital because they want to keep their currency relatively stable. I think that’s one of the uncertainties in the market right now. A lot of Chinese investment capital, however, was already offshore or in Hong Kong. The ability of the Chinese government to stop those investors and keep the dollars in China remains an unknown.