Vehicle efficiency standards have long been considered vital to cutting the United States’ oil imports. Strengthened last year with the added hope of reducing greenhouse gas emissions, the standards have been advanced as a way to cut vehicle emissions in half and save consumers more than $1.7 trillion at the pump. But researchers at MIT find that, compared to a gasoline tax, vehicle efficiency standards come with a steep price tag.

“Tighter vehicle efficiency standards through 2025 were seen as an important political victory. However, the standards are a clear example of how economic considerations are at odds with political considerations,” says Valerie Karplus, the lead author of the study and a researcher with the MIT Joint Program on the Science and Policy of Global Change. “If policymakers had made their decision based on the broader costs to the economy, they would have gone with the option that was least expensive – and that’s the gasoline tax.”

The study, published this week in the March edition of the journal Energy Economics, compares vehicle efficiency standards to a tax on fuel as a tool for reducing gasoline use in vehicles. The researchers found that regardless of how quickly vehicle efficiency standards are introduced, and whether or not biofuels are available, the efficiency standards are at least six times more expensive than a gasoline tax as a way to achieve a cumulative reduction in gasoline use of 20 percent through 2050. That’s because a gasoline tax provides immediate, direct incentives for reducing gasoline use, both by driving less and investing in more efficient vehicles. Perhaps a central reason why politics has trumped economic reasoning, Karplus says, is the visibility of the costs.

“A tax on gasoline has proven to be a nonstarter for many decades in the U.S., and I think one of the reasons is that it would be very visible to consumers every time they go to fill up their cars,” Karplus says. “With a vehicle efficiency standard, your costs won't increase unless you buy a new car, and even better than that, policymakers will tell you you’re actually saving money. As my colleague likes to say, you may see more money in your front pocket, but you’re actually financing the policy out of your back pocket through your tax dollars and at the point of your vehicle purchase.”

Along with being more costly, Karplus and her colleagues find that it takes longer to reduce emissions under the vehicle efficiency standards. That’s because, with more efficient vehicles, it costs less to drive, so Americans tend to drive more. Meanwhile, the standards have no direct impact on fuel used in the 230 million vehicles currently on the road. Karplus also points out that how quickly the standards are phased in can make a big difference. The sooner efficient vehicles are introduced into the fleet, the sooner fuel use decreases and the larger the cumulative decrease would be over the period considered, but the timing of the standards will also affect their cost.

The researchers also find that the effectiveness of the efficiency standards depends in part on the availability of other clean-energy technologies, such as biofuels, that offer an alternative to gasoline.

“We see the steepest jump in economic cost between efficiency standards and the gasoline tax if we assume low-cost biofuels are available,” Karplus says. “In this case, if biofuels are available, a lower gasoline tax is needed to displace the same level of fuel use over the 2010 to 2050 time frame, as biofuels provide a cost-effective way to displace gasoline above a certain price point. As a result, a lower gas tax is needed to achieve the 20 percent cumulative reduction.”

To project the impact of vehicle efficiency standards, Karplus and her colleagues improved the MIT Emissions Predictions and Policy Analysis Model that is used to help understand how different scenarios to constrain energy affect our environment and economy. For example, they represent in the model alternatives to the internal combustion engine based on the expected availability and cost of alternative fuels and technologies, as well as the dynamics of sales and scrappage that affect the composition of the vehicle fleet. Their improvements to the model were recently published in the January 2013 issue of the journal Economic Modelling.

MIT researchers find vehicle efficiency standards are at least six times more costly than a tax on fuel.

Publication Date:

Caption:

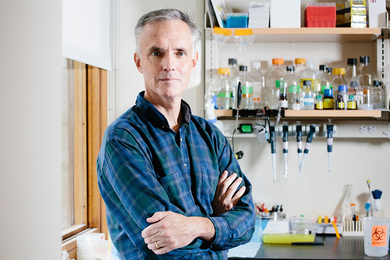

Valerie Karplus is the lead author of the study and a researcher at the MIT Joint Program on the Science and Policy of Global Change.