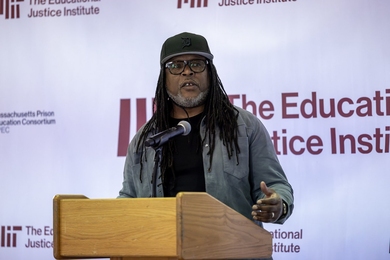

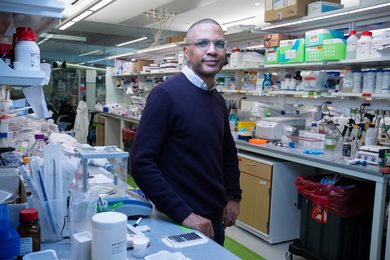

Earlier this month, heavyweight bank JP Morgan Chase announced it had lost at least $2 billion on a single trade — a figure that could grow as the firm struggles to unwind its position. The event has prompted a public airing of many questions: What went wrong, and why didn’t JP Morgan recognize the problem sooner? Should the bet be regarded as a risky proprietary trade, or a hedge designed to offset potential risks on other trades? And what will it take to prevent future blowups like this? MIT News spoke about the issue recently with Andrew Lo, the Charles E. and Susan T. Harris Professor of Finance at the MIT Sloan School of Management. Lo, an expert in financial markets, was recently named one of the world’s 100 most influential people by Time magazine.

Q. You’ve suggested that to properly learn from financial mishaps, and properly regulate the industry, we need a financial equivalent of the National Transportation Safety Board (NTSB), which investigates airplane accidents, among other things, and has helped make flying safer. At this point, how much do we know about this JP Morgan trade?

A. I think there’s a lot more we need to learn about what happened, for a couple of reasons. I’m a firm believer in the need for financial regulation, so I’m not in the camp that says, “Let markets run wild.” But it’s tremendously costly to implement any new regulation, never mind the existing ones, so before we propose new rules, we really want to make sure we know what we’re doing. One of the interesting things about what the NTSB does and why it takes so long to put together a definitive accident report is that they spend tremendous effort not only in figuring out what happened, but also in ruling out all sorts of other possible explanations, so that in the end, they arrive at a single narrative of what actually did happen. I could rattle off three or four different narratives about what may have happened at JP Morgan, and one of them may even be true, but if we’re going to make rules in response to this event, we have an obligation to the American people to get it right. And that’s where accident investigation becomes essential.

Q. Some people have wanted to ban proprietary trading by banks that collect regular deposits — the so-called “Volcker Rule.” A central question about this JP Morgan incident is whether it was a proprietary trade, or strictly a hedge against potential losses in other trades — or if we can even make such a distinction. Limited though our knowledge is, how do you assess this issue?

A. I think the answer is very simple: Yes, we can tell the difference. And this shows how important having the right information is in being able to come up with the right narrative. There is one very simple question that you can ask — which has a definitive answer — about the small number of individuals who were responsible for managing this group at JP Morgan and putting on the specific trades that lost these large amounts of money. That question is: How were they compensated on an annual basis? Were they paid a salary and a bonus, and was the bonus a function of the profitability of the group, or was the bonus a function of the hedging ability of the group? If you can answer this question — and it definitely has an answer to it; it’s not a metaphysical question — you will have your answer as to whether it was proprietary trading or hedging. I don’t know the answer, but I know the answer exists, and I know that certainly the government can get that answer with a single phone call.

Q. What does this episode tell us about the limitations of risk management generally, at JP Morgan or elsewhere? And what can be done to improve risk management?

A. This goes to a much broader question about modern capitalism: How can any small number of individuals manage a $100 billion company? The answer is the same one we give for many complex tasks, which is that we have to build technology allowing us to leverage our human judgment in much broader contexts. The question is whether we want to or not. Right now we don’t have that level of commitment. Maybe after this JP Morgan fiasco, we will.

Clearly, risk is a complex set of issues in an organization like JP Morgan; I don’t think it can be reduced to a single number in any set of circumstances. In large, complex organizations, technology can play a critical role in tracking, aggregating, monitoring and communicating the entire gamut of risks that exist so that decision-makers can make well-informed judgments. The portfolios JP Morgan deals with are highly complex and highly dynamic, meaning they can change rapidly from day to day. My conjecture is that the senior management of this particular unit at JP Morgan did not have timely access to the risks they were being exposed to. … I believe [JP Morgan Chase CEO] Jamie Dimon has acknowledged as much.

Another part of the challenge is incentives. Risk management is not a profit center; it’s typically a cost center. At the same time, CEOs and CFOs make decisions based on what they think shareholders want right now, and what shareholders usually want is price appreciation. When you invest in a serious risk-management effort, you spend a lot of money in the short run, and won’t necessarily be able to identify the blowups you avoided because of that effort. That’s why we need to change our culture.

It’s like fire codes. Putting sprinkler systems and fire alarms and extra exits in buildings is expensive, and the benefits are hard to detect unless there is a fire. In the United States, we had to experience a really serious loss of life, in New York’s Triangle Shirtwaist Factory fire of 1911, before we decided as a society that all commercial buildings are required to have fire protection — that’s the law, no more debate, end of story. We have to have that same attitude about risk management, and decide that to continue growing our economy, all corporations need to structure their governance so that risk management is a separate function that reports directly to the board, and that the chief risk officer is compensated and incentivized to identify risks and create financial stability for the company. Unless we do that, we’re going to be constantly subjected to this endless cycle of fear and greed, fear and greed, fear and greed.

Q. You’ve suggested that to properly learn from financial mishaps, and properly regulate the industry, we need a financial equivalent of the National Transportation Safety Board (NTSB), which investigates airplane accidents, among other things, and has helped make flying safer. At this point, how much do we know about this JP Morgan trade?

A. I think there’s a lot more we need to learn about what happened, for a couple of reasons. I’m a firm believer in the need for financial regulation, so I’m not in the camp that says, “Let markets run wild.” But it’s tremendously costly to implement any new regulation, never mind the existing ones, so before we propose new rules, we really want to make sure we know what we’re doing. One of the interesting things about what the NTSB does and why it takes so long to put together a definitive accident report is that they spend tremendous effort not only in figuring out what happened, but also in ruling out all sorts of other possible explanations, so that in the end, they arrive at a single narrative of what actually did happen. I could rattle off three or four different narratives about what may have happened at JP Morgan, and one of them may even be true, but if we’re going to make rules in response to this event, we have an obligation to the American people to get it right. And that’s where accident investigation becomes essential.

Q. Some people have wanted to ban proprietary trading by banks that collect regular deposits — the so-called “Volcker Rule.” A central question about this JP Morgan incident is whether it was a proprietary trade, or strictly a hedge against potential losses in other trades — or if we can even make such a distinction. Limited though our knowledge is, how do you assess this issue?

A. I think the answer is very simple: Yes, we can tell the difference. And this shows how important having the right information is in being able to come up with the right narrative. There is one very simple question that you can ask — which has a definitive answer — about the small number of individuals who were responsible for managing this group at JP Morgan and putting on the specific trades that lost these large amounts of money. That question is: How were they compensated on an annual basis? Were they paid a salary and a bonus, and was the bonus a function of the profitability of the group, or was the bonus a function of the hedging ability of the group? If you can answer this question — and it definitely has an answer to it; it’s not a metaphysical question — you will have your answer as to whether it was proprietary trading or hedging. I don’t know the answer, but I know the answer exists, and I know that certainly the government can get that answer with a single phone call.

Q. What does this episode tell us about the limitations of risk management generally, at JP Morgan or elsewhere? And what can be done to improve risk management?

A. This goes to a much broader question about modern capitalism: How can any small number of individuals manage a $100 billion company? The answer is the same one we give for many complex tasks, which is that we have to build technology allowing us to leverage our human judgment in much broader contexts. The question is whether we want to or not. Right now we don’t have that level of commitment. Maybe after this JP Morgan fiasco, we will.

Clearly, risk is a complex set of issues in an organization like JP Morgan; I don’t think it can be reduced to a single number in any set of circumstances. In large, complex organizations, technology can play a critical role in tracking, aggregating, monitoring and communicating the entire gamut of risks that exist so that decision-makers can make well-informed judgments. The portfolios JP Morgan deals with are highly complex and highly dynamic, meaning they can change rapidly from day to day. My conjecture is that the senior management of this particular unit at JP Morgan did not have timely access to the risks they were being exposed to. … I believe [JP Morgan Chase CEO] Jamie Dimon has acknowledged as much.

Another part of the challenge is incentives. Risk management is not a profit center; it’s typically a cost center. At the same time, CEOs and CFOs make decisions based on what they think shareholders want right now, and what shareholders usually want is price appreciation. When you invest in a serious risk-management effort, you spend a lot of money in the short run, and won’t necessarily be able to identify the blowups you avoided because of that effort. That’s why we need to change our culture.

It’s like fire codes. Putting sprinkler systems and fire alarms and extra exits in buildings is expensive, and the benefits are hard to detect unless there is a fire. In the United States, we had to experience a really serious loss of life, in New York’s Triangle Shirtwaist Factory fire of 1911, before we decided as a society that all commercial buildings are required to have fire protection — that’s the law, no more debate, end of story. We have to have that same attitude about risk management, and decide that to continue growing our economy, all corporations need to structure their governance so that risk management is a separate function that reports directly to the board, and that the chief risk officer is compensated and incentivized to identify risks and create financial stability for the company. Unless we do that, we’re going to be constantly subjected to this endless cycle of fear and greed, fear and greed, fear and greed.