Audio

Taking out a loan to attend college is an investment in your future. But unlike in the United States, students in Pakistan don’t have easy access to college loans. Instead, most families must stomach higher interest rates for personal loans that can require collateral like land or homes. As a result, college is inaccessible for many students. It’s one reason why only about 13 percent of Pakistani students attend college.

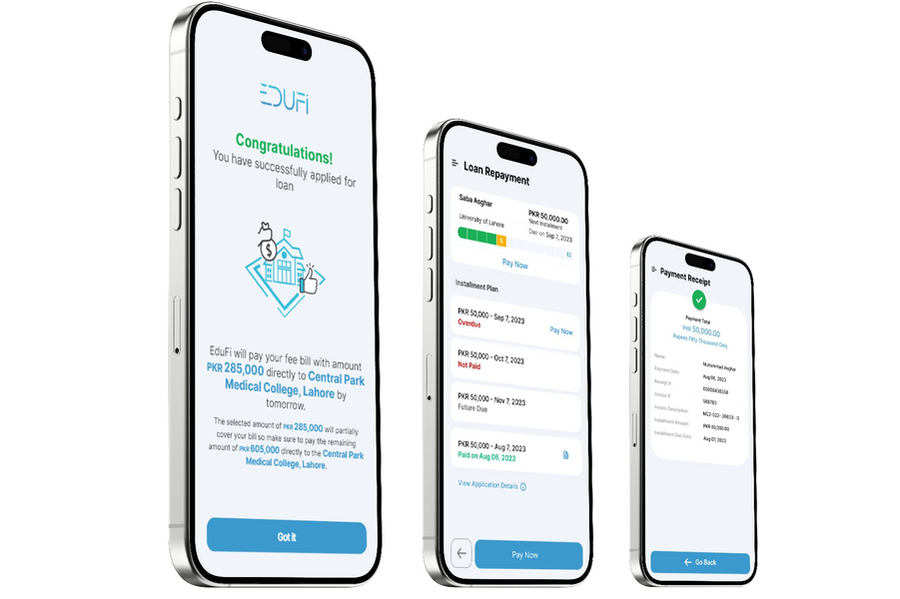

Now EduFi, founded by Aleena Nadeem ’16, is offering low-interest student loans to a broader swath of Pakistanis. EduFi, which is short for “education finance,” uses an artificial intelligence-based credit scoring system to qualify borrowers and pay colleges directly. The borrowers then make monthly payments to EduFi along with a service fee of 1.4 percent — far lower than what is available for most students today.

“The fees for college are extremely unaffordable for the average middle-class person right now,” Nadeem explains. “With our ‘Study Now, Pay Later’ system, we’re breaking that big upfront cost into installments, which makes it more affordable for both existing college students and a new group of people that never thought higher education was possible.”

EduFi was incorporated in 2021, and after gaining regulatory approval, the company began disbursing loans to people across Pakistan last year. In the first six months, EduFi disbursed more than half a million dollars in loans. Since then, the company’s inclusive approach to qualifying applicants has been validated: Today, less than 1 in 10,000 of those loans are not being repaid.

As awareness about EduFi grows, Nadeem believes the company can contribute to Pakistan’s modernization and development more broadly.

“We are accepting so many more people that would not have been able to get a bank loan,” Nadeem says. “That gets more people to go to college. The impact of directing cheap and fast credit to the educational sector on a developing country like Pakistan is huge.”

Better credit

At the British international high school Nadeem attended, no one had ever gotten into an Ivy League school. That made her acceptance into MIT a big deal.

“It was my first choice by far,” Nadeem says.

When she arrived on campus, Nadeem took classes at MIT that taught her about auctions, risk, and credit.

“In the work I’m doing with EduFi now, I’m applying what I learned in my classes in the real world,” Nadeem says.

Nadeem worked in the credit division at Goldman Sachs in London after graduation, but barriers to accessing higher education in her home country still bothered her.

In Pakistan, some targeted programs offer financial support for students with exceptionally high grades who can’t afford college, but the vast majority of families must find other ways to finance college.

“Most students and their families have to get personal loans from standard banks, but that requires them to open a bank account, which could take two months,” Nadeem explains. “Fees in Pakistan’s education sector must be paid soon after the requests are sent, and by the time banks accept or reject you, the payment could already be late.”

Private loans in Pakistan come with much higher interest rates than student loans in America. Many loans also require borrowers to put up property as collateral. Those challenges prevent many promising students from attending college at all.

EduFi is using technology to improve the loan qualification process. In Pakistan, the parent is the primary borrower. EduFi has developed an algorithmic credit scoring system that considers the borrower’s financial history then makes payments directly to the college on their behalf. EduFi also works directly with colleges to consider the students’ grades and payment history to the school.

Borrowers pay back the loan in monthly installments with a 1.4 percent service fee. No collateral is required.

“We are the first movers in student lending and currently hold the largest student loan portfolio in the country,” Nadeem says. “We’re offering extremely subsidized rates to a lot of people. Our rates are way cheaper than the bank alternatives. We still make a profit, but we’re impact-focused, so we make profit through disbursing to a larger number of people rather than increasing the margin per person.”

Nadeem says EduFi’s approach qualifies far more people for loans compared to banks and does so five times faster. That makes college more accessible for students across Pakistan.

“Banks charge high interest rates to the people with the best credit scores,” Nadeem says. “By not taking collateral, we really open up the credit space to new people who would not have been able to get a bank loan. Easier credit gives the average middle-class individual the ability to change their families’ lives.”

Helping countries by helping people

EduFi received its non-banking financial license in February 2024. The company gained early traction last year through word of mouth and soon opened to borrowers across the country. Since then, Nadeem says many people have traveled long distances to EduFi’s headquarters to confirm they’re a credible operation. Nadeem also regularly receives messages from students across Pakistan thanking EduFi for helping them attend college.

After further proving out its model this year, EduFi plans to expand to Saudi Arabia. Eventually, it plans to offer its loans to students throughout the Middle East, and Nadeem believes the global student loan system could be improved using EduFi’s approach.

“EduFi is modeled after SoFi in San Francisco,” Nadeem says of the large finance company that started by offering student loans and expanded to mortgages, credit cards, and other banking services. “I’m trying to build the SoFi of Pakistan and the Middle East. But it’s really a combination of SoFi and Grameen Bank [in Bangladesh], which extends credit to lower-income people to lift them out of poverty.”

By helping people extend their education and reach their full potential, Nadeem believes EduFi will one day accelerate the development of entire nations.

“Education is the core pillar from which a country stands,” Nadeem says. “You can’t progress as a country without making education as accessible and affordable as possible. EduFi is achieving that by directing capital at what is frankly a starving education sector.”