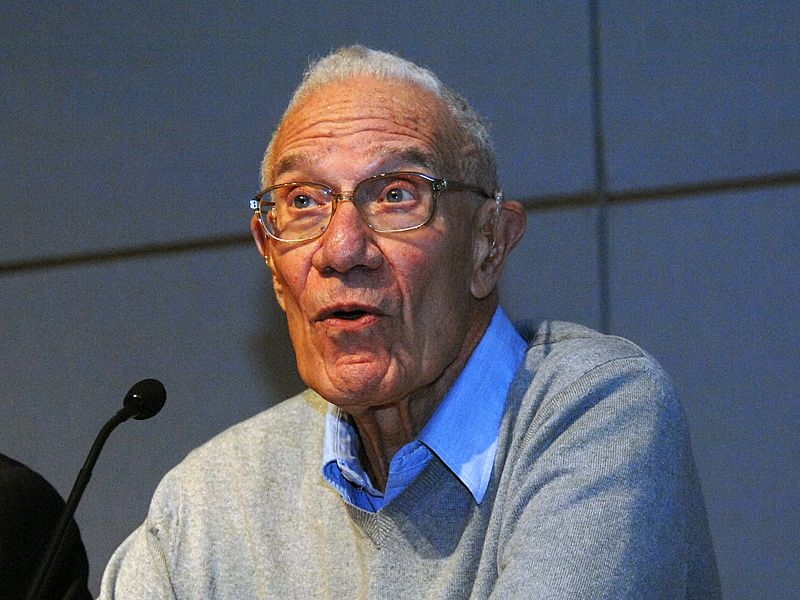

Economist Robert Solow's seminal work in the 1950s and 1960s showed how new technologies create a large portion of economic growth, an achievement for which he was awarded the 1987 Nobel Prize in Economics. With the economy seemingly in need of a technological boost again, the emeritus Institute Professor sat down with MIT News for a talk in his office this week.

Q. What is your assessment of the economy now, and where is it going?

A. Forecasting is hard and dangerous, and I don't do it. But it appears that the worst of the recession is over. However, the economy will be getting better slowly. And saying the economy is getting better is not the same thing as saying the economy is doing well. Real GDP fell by about 3.5 percent during the recession. But capacity increased 2.5 percent. We were producing 6 percent less than we knew how to produce. That gap has to narrow to reduce unemployment. If we rely only on the normal self-curing powers of a market economy, it may take until late in 2010 or early 2011 before we reduce that gap. So for that reason we should not rule out further stimulus in the next six to nine months. It's not easy because we have this enormous deficit. But we should recognize that even if the economy improves on its own, it won't do very much.

I had hoped that President Obama at the beginning of his term, while his popularity was at its highest, would have taken a very strong line. I don't think he could have asked for $1.4 trillion in stimulus, but he could have had a slightly bigger and better package, had he bullied a little bit more. If Obama or [David] Axelrod were to reply, "Boy, are you naïve," about the politics, I don't think I could have answered that. I'm just saying what I think God would have done if God were making these decisions. Congress falls well short of God.

Q. Your research made clear how much technology can contribute to economic growth. To what extent might we see technology driving growth now?

A. I actually think the situation of the economy calls for a surge in technologically oriented investment. We have to expect consumer spending to be weak in our economy, not just for six months, but for the next few years. It will not be as strong a driving force as it has been the past several years. Something has to take its place. Government spending can't, since government will have a hard time financing the inevitable deficits and is not in a position to aggressively increase its deficit spending.

That leaves two sources of expenditure to replace the pullback of consumers. One of those is net exports. That's a long story. The other is business investment. We need business investment to support the economy. We have every reason to want to divert our resources toward secure and renewable sources of energy, new materials and environmental improvement. It's our job, a place like MIT, to produce those new technologies, then it's the job of private industry to grab them, but I also think it's the job of the federal government to shift incentives, from incentives to consume more to incentives to invest more. Obama ran on this kind of platform, and if he can put some money behind that fundamentally correct view, he might generate something. It's going to take more than that to replace 5 percent of GDP, but that would be a neat place to start.

Q. In 2005 you wrote that you were "disaffected" by the "assumptions and methods" of macroeconomics. There has been a lot of debate about this subject in the last month. What is your assessment of the state of macroeconomics now?

A. The disaffection I expressed is still my assessment. The beast [the economic crisis] expressed the same disaffection in 2007 and 2008, and the currently fashionable way of doing macroeconomics in the profession literally had nothing to offer in response. The problem as I have thought about it is that currently fashionable macroeconomics likes to formulate things in a way that inevitably endows the economy with more coherence and purpose than we have any right to assume. I certainly hope this is obvious enough to the younger people in the profession, the graduate students and even junior faculty. I expect there will be a revival of doing macroeconomics that does not push that kind of coherence on aggregate economic behavior. Which is not to say that some individuals don't behave in a coherent way, but the system does not translate that behavior into something like a super-individual.

Q. What is your assessment of the economy now, and where is it going?

A. Forecasting is hard and dangerous, and I don't do it. But it appears that the worst of the recession is over. However, the economy will be getting better slowly. And saying the economy is getting better is not the same thing as saying the economy is doing well. Real GDP fell by about 3.5 percent during the recession. But capacity increased 2.5 percent. We were producing 6 percent less than we knew how to produce. That gap has to narrow to reduce unemployment. If we rely only on the normal self-curing powers of a market economy, it may take until late in 2010 or early 2011 before we reduce that gap. So for that reason we should not rule out further stimulus in the next six to nine months. It's not easy because we have this enormous deficit. But we should recognize that even if the economy improves on its own, it won't do very much.

I had hoped that President Obama at the beginning of his term, while his popularity was at its highest, would have taken a very strong line. I don't think he could have asked for $1.4 trillion in stimulus, but he could have had a slightly bigger and better package, had he bullied a little bit more. If Obama or [David] Axelrod were to reply, "Boy, are you naïve," about the politics, I don't think I could have answered that. I'm just saying what I think God would have done if God were making these decisions. Congress falls well short of God.

Q. Your research made clear how much technology can contribute to economic growth. To what extent might we see technology driving growth now?

A. I actually think the situation of the economy calls for a surge in technologically oriented investment. We have to expect consumer spending to be weak in our economy, not just for six months, but for the next few years. It will not be as strong a driving force as it has been the past several years. Something has to take its place. Government spending can't, since government will have a hard time financing the inevitable deficits and is not in a position to aggressively increase its deficit spending.

That leaves two sources of expenditure to replace the pullback of consumers. One of those is net exports. That's a long story. The other is business investment. We need business investment to support the economy. We have every reason to want to divert our resources toward secure and renewable sources of energy, new materials and environmental improvement. It's our job, a place like MIT, to produce those new technologies, then it's the job of private industry to grab them, but I also think it's the job of the federal government to shift incentives, from incentives to consume more to incentives to invest more. Obama ran on this kind of platform, and if he can put some money behind that fundamentally correct view, he might generate something. It's going to take more than that to replace 5 percent of GDP, but that would be a neat place to start.

Q. In 2005 you wrote that you were "disaffected" by the "assumptions and methods" of macroeconomics. There has been a lot of debate about this subject in the last month. What is your assessment of the state of macroeconomics now?

A. The disaffection I expressed is still my assessment. The beast [the economic crisis] expressed the same disaffection in 2007 and 2008, and the currently fashionable way of doing macroeconomics in the profession literally had nothing to offer in response. The problem as I have thought about it is that currently fashionable macroeconomics likes to formulate things in a way that inevitably endows the economy with more coherence and purpose than we have any right to assume. I certainly hope this is obvious enough to the younger people in the profession, the graduate students and even junior faculty. I expect there will be a revival of doing macroeconomics that does not push that kind of coherence on aggregate economic behavior. Which is not to say that some individuals don't behave in a coherent way, but the system does not translate that behavior into something like a super-individual.