The Institute’s commitment to financial aid will remain robust for 2021-22, increasing from last year’s announced budget of $147 million to $155.2 million. The increase will offset a 3.85 percent rise in tuition and changes in housing, dining, and other estimated costs. The net cost for an average MIT student receiving need-based aid will be $22,969.

When measured in real dollars, the average cost of an MIT education for those who receive financial aid has been reduced by 32 percent over the past two decades.

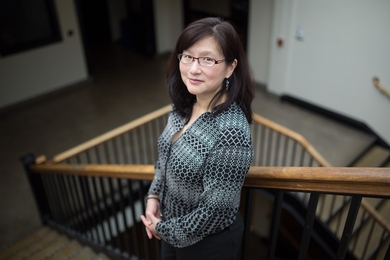

In response to the Covid-19 pandemic, during the past academic year MIT held tuition rates steady and provided a broad range of financial and academic support for students. “Given the challenging times the world has faced, we are pleased to be able to continue our longstanding commitment to making an MIT education affordable,” says Stu Schmill, dean of admissions and student financial services.

The estimated average MIT scholarship for students receiving financial aid next year is $54,601. More than 38 percent of MIT undergraduates receive aid sufficient to allow them to attend the Institute tuition-free. For undergraduates not receiving any need-based financial aid, tuition and fees will be $55,878 next year. Including housing and dining costs, the total will come to $73,978.

“As outlined by MIT President Reif, we expect to ramp up to a full return of in-person learning and living on campus this fall,” says Ian A. Waitz, vice chancellor for undergraduate and graduate education and Jerome C. Hunsaker Professor of Aeronautics and Astronautics. “We are in this fortunate position because of the enormous commitment the Institute has made to continue its operations over the past year and develop new ways to support the success of our students — many of which will persist post-pandemic.”

Like many of its peers, MIT switched to remote learning in March 2020. In recognition that there were financial uncertainties for many families given the pandemic, the Institute provided a $5,000 Covid-era grant to all enrolled undergraduate students.

“Last March, when students were quickly asked to leave campus, we increased the MIT Scholarship for students on aid to substitute for the remaining half-semester work-study portion of their financial aid package,” says Waitz.

The changes entailed promptly processing over $13.7 million in prorated, mid-semester refunds to students for more than 3,000 housing charges, 2,200 meal plans, and 11,000 student life fees; and offered up to six months’ forbearance to loan borrowers and 0 percent interest on student loans for up to six months. Moreover, financial aid awards were not adjusted, meaning that students received refunds from MIT for any additional expenses they incurred, including living expenses.

“We responded quickly to enable students to keep making academic progress, wherever they were,” says Waitz. ”Beyond financial support, we created a student coaching pilot, a technology loaner program (including iPads, laptops, and hotspots) and the new Experiential Learning Opportunities program, providing a guaranteed $1,900 for pursuing a hands-on learning project.”

Despite the financial toll of the pandemic, MIT remains one of only five American colleges and universities that admit all undergraduate students without regard to their financial circumstances; that award all financial aid based on need; and that meet, without loans, the full estimated financial need of each student.

For students with family incomes under $90,000 a year and typical assets, most students attend the Institute tuition-free. While the Institute’s financial aid program primarily supports students from lower- and middle-income households, even families earning more than $250,000 may qualify for need-based financial aid based on their family circumstances, such as if two or more children are in college at the same time.

About 60 percent of MIT’s undergraduates receive need-based financial aid from the Institute and 19 percent receive federal Pell Grants, which generally go to U.S. students with family incomes below $60,000.

MIT treats the Pell Grant in a unique way to further support low-income students. Unlike most other colleges and universities, MIT allows students to use the Pell Grant to offset what they are expected to contribute through work during the semester and the summer. MIT also changed its financial aid policies recently to provide more support for U.S. veterans.

In 2020, 78 percent of MIT seniors graduated with no debt; of those who did assume debt to finance their education, the median indebtedness at graduation was $15,614.