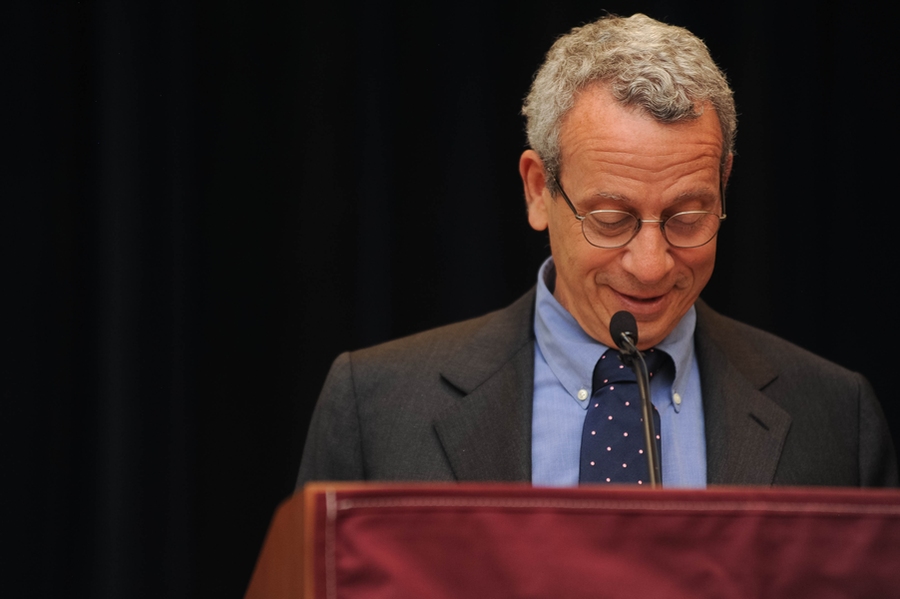

MIT Sloan School of Management Professor Stephen Ross, inventor of the arbitrage pricing theory and a foundational member of the practice of modern finance, died Friday, March 3. He was 73.

Ross, the Franco Modigliani Professor of Financial Economics, was best known for his arbitrage pricing theory, developed in 1976. The theory, commonly known as APT, is used to identify and exploit mispriced assets by tracking a number of macroeconomic factors. It serves as a framework for analyzing risks and returns. The APT is widely applied in investment management practice today. Ross is also responsible for the economic theory of agency and was the co-creator of the Cox-Ingersoll-Ross model of pricing government bonds and the binomial model for pricing options.

Those theories and models are cornerstones of neoclassical finance, a field which Ross pioneered and defended in a 2004 book of the same name. MIT Sloan Professor Leonid Kogan, a former student, co-authored the behavioral economics-based “The Price Impact and Survival of Irrational Traders” with Ross in 2006.

“Steve was a scholar. If the model tells you otherwise and the results go against his beliefs, he updates his beliefs,” Kogan said. “His main position wasn’t dogmatic. He was trying to get to the truth.”

More recently, Ross developed the recovery theorem, which allows the separation of probability distribution and risk aversion to forecast returns from state prices. His most recent research “focused on applying the recovery theorem to existing option pricing data, extending the recovery approach to fixed income markets, and using options to improve the performance of institutional portfolios,” according to his biography on MIT Sloan’s website.

“Steve Ross will be remembered as an intellectual giant,” MIT Sloan Dean David Schmittlein wrote in a message to the MIT Sloan community. “What is known today about the science of finance and its application owes much to Steve’s pioneering work, ranging from asset pricing to investment management and to corporate finance. Steve did not believe in narrow specialization and intellectual boundaries. It is difficult to imagine the discipline of modern finance without Steve’s contributions.”

“Steve Ross was one of the giants of modern finance with a razor sharp intellect and a heart of gold,” said MIT Sloan Professor Andrew Lo. “The cold, hard logic of his mathematical theories stood in sharp contrast to the warmth of his personality. He was more humanist than financial economist, and was deeply connected in so many communities that would rightly claim Steve as their own. This is an enormous loss to MIT and the world.”

A bias for practical research

MIT’s motto, "mens et manus," or mind and hand, emphasizes both scientific thought and the development of its practical applications. As one of the founders of modern finance, Ross was a perfect fit for the MIT culture, said MIT Sloan professor and Nobel laureate Robert Merton.

“What’s very unusual about finance — and Steve exemplified it — is the most sophisticated models, the theories, the empirical work … get accepted quite rapidly into the mainstream of practice,” Merton said. “The binomial model literally is used millions of times a day.”

“Steve was a very quantitative guy and very theoretical, but he also had a strong practical streak in the sense that he really liked to see this stuff get used,” Merton said.

In Stephen Ross Prize, recognition of a storied career

In 2006, a group of Ross’ former students began to secretly raise funds amongst themselves to establish the Stephen A. Ross Prize in Financial Economics, to recognize published research that “exemplifies Steve’s research style and values.” The group raised more than $600,000, surpassing an initial $250,000 goal, and established the Foundation for the Advancement of Research in Financial Economics to award the prize. The prize has since been granted four times between 2008 and 2015.

Merton said the prize’s growing prestige is a testament to Ross’ following, including his list of PhD students, a who’s who of a generation of finance researchers and practitioners. Kogan described the cohort of students advised by Ross as “unmatched in our profession.” Ross, Kogan said, was a cheerleader for his students, giving them space and support to nurture ideas that other advisers may have rejected.

Ross received a bachelor’s degree from Caltech in 1965 and a PhD in economics from Harvard University in 1970. He served on the faculties at the Wharton School of the University of Pennsylvania and at Yale University before joining MIT Sloan, first as the Fischer Black Visiting Professor in 1997, then as a professor in 1998. His career was marked by many significant awards, most recently the 2015 Deutsche Bank Prize in Financial Economics and the 2012 Onassis Prize for Finance. He was the 1996 International Association for Quantitative Finance Financial Engineer of the Year and won the 2007 Jean-Jacques Laffont Prize.

In the private sector, Ross founded a series of asset management firms, including Roll and Ross Asset Management, and was more recently the co-founder of Ross, Jeffrey and Antle LLC, a Connecticut institutional investment firm. In 1988, he was president of the American Finance Association. He advised government agencies and had served as a director at Freddie Mac, CREF, and elsewhere.

A more complete list of Ross’ awards and affiliations is available on his MIT Sloan faculty directory page.

High standards and a reputation for kindness

Merton remembered Ross as a connoisseur of fine wine and cuisine who was an amiable companion and colleague, even as he accepted nothing but the best in his work.

“I’m going to miss his smile,” Merton said. “He could be a very tough guy. He had high standards and he made no bones about expressing them. But he also had a nice way about him.”

MIT Sloan Professor Jiang Wang concurred, saying Ross conducted himself in an “artful” manner, both professionally and in personal encounters.

“The other thing I found very inspiring about him is that he was always very positive, very optimistic, not just about research, but about other people,” Wang said. “And yet he didn’t compromise a bit when it came to intellectual pursuits.”

Ross is survived by his wife, Carol, two children, and two granddaughters. Plans for services and a celebration of his life by MIT Sloan are forthcoming.