The MIT Forum for Supply Chain Innovation announced today that it has released survey results from its 2014 global manufacturing study led by MIT professor David Simchi-Levi and conducted with Supply Chain Digest, and will issue a full report on the results, titled, “Global Forces: The Transformation of U.S. Manufacturing.”

In total, 231 participants completed the survey, 122 of which were manufacturing-only companies. Out of those 122 companies, 89 were U.S. companies, defined as having their headquarters in the United States.

The top three manufacturing-only industries that responded to the survey were: computers and electronics (16.4 percent); food and beverage (9.0 percent); and electrical equipment (9.0 percent). By revenue, manufacturing-only companies that responded were categorized as: revenue under $1 billion (54 percent); revenue of $1 billion to $10 billion (25 percent); and revenue greater than $10 billion (21 percent).

Key findings

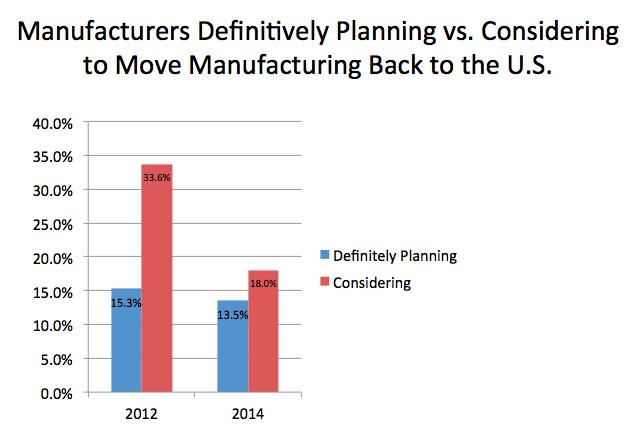

In the 2014 study, 13.5 percent of U.S. manufacturing companies have reported that they have already made a decision to move some manufacturing activities back to the U.S., with 18.0 percent of U.S. manufacturers stating that they are “considering” bringing back manufacturing activities to the U.S.

This finding is similar to the data from the MIT Forum’s 2013 report, “U.S Re-shoring: A Turning Point,” which was based on the results of its 2012 U.S. re-shoring survey. Interestingly, U.S. manufacturers who stated they are “considering” re-shoring manufacturing activities responded that the majority of re-shoring activity for 2014 into 2016 would be focused on production (9.4 percent) followed by packaging (5.9 percent), design (3.6 percent), and assembly (3.6 percent).

Perhaps even more significant is that U.S. manufacturers who stated they were “definitively” planning on re-shoring manufacturing activities responded that the majority of their re-shoring activity for 2014 into 2016 would be focused on moving production back to the U.S. Activity priorities were led by production (21.1 percent) followed by design (5.6 percent), assembly (5.0 percent), and Packaging (5.0 percent). As such, the data indicate an increasing trend to re-shore production activities back to the U.S. for some time to come.

The 2013 “U.S. Re-shoring: A Turning Point” report indicated for U.S. manufacturing companies a significant disparity between companies that are "considering" (33.6 percent) versus those that are "definitively" (15.3 percent) planning on re-shoring; the disparity was independent of company size. Data from the 2014 study indicate that this disparity has been significantly reduced, with 13.5 percent of U.S. manufacturers now “definitively” planning and 18.0 percent “considering.”

U.S. manufacturers reported that the two key drivers of the change in manufacturing are reducing risk/volatility (73 percent) and time to market (73 percent), followed by cost reductions/total landed cost calculations (60 percent), more control (53 percent), and hidden supply-chain costs (53 percent).

Looking ahead

The survey once again asked the participating U.S. companies to identify government actions that will accelerate the re-shoring process. According to the data, the top two government actions that would make a difference are tax credits (53 percent) and corporate tax reductions (53 percent), followed by providing ramp incentives (50 percent), providing better education training for required skills (41 percent), and providing better infrastructure (31 percent).

MIT Professor David Simchi-Levi, founder of the MIT Forum, says, “The data from our 2014 survey, which support the conclusions from our 2013 report, indicate that the shift in the global manufacturing footprint is increasing. The fact that 13.5 percent of the companies are moving manufacturing back, with a significant focus on re-shoring production activities, suggests that U.S. manufacturers are positive about the future of manufacturing in the U.S. This does not necessarily mean the end of manufacturing in low-cost countries. Rather, it suggests that we are still in the process of transformation from a global manufacturing strategy, where the focus is on low cost countries, to a global-local strategy, where some activities are globalized while others are localized to reduce risk, cut time-to-market, take advantage of local government incentives, and respond quickly to changes in market demand.”

Dan Gilmore, editor of Supply Chain Digest, says, “It appears what is happening is that as a variety of factors make U.S. production more cost-competitive, the decision drivers for re-shoring move beyond simply cost to factors such as risk mitigation and market responsiveness.”

The MIT Forum for Supply Chain Innovation is a community composed of academics and industry members whose support allows forum researchers to provide customer-focused solutions to design and manage the new supply chain. The forum has pioneered a deeper understanding of the supply chain and its relationship to corporate strategy and has broad support from a wide cross-section of industry.

In June 2012, the forum launched the Manufacturing Technology Advisory Board in response to forum members’ request for technology-transformation guidance. The board consists of MIT academic and research leaders, with major technology providers and industry leaders collaborating on key issues around U.S. manufacturing.

For more information on the release of the full 2014 “Global Forces: The Transformation of U.S. Manufacturing” report, please email Lsheppar@mit.edu.