Despite signs of a widening disconnect between buyers and sellers, transaction sale prices of U.S. commercial property owned by institutional investors rose 2.1 percent in the first quarter of 2008 after two consecutive quarterly declines, according to an index produced by the MIT Center for Real Estate.

The modest upturn in the quarterly transaction-based index (TBI) means that while prices for properties such as shopping malls, apartment complexes and office towers are still some 6 percent below peak values, there may be a ray of light in real estate markets.

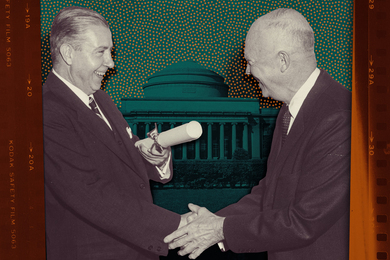

"The uptick in the index this quarter highlights the difference between the commercial property market and the U.S. housing market," said Professor David Geltner, director of the MIT/CRE.

Housing has been battered by the mortgage crisis and aggressive lending prior to last summer. But Geltner said commercial properties, which produce regular income and serve as a major investment asset class, are generally still experiencing good performance in terms of high income, good occupancy, low commercial mortgage delinquency and substantial equity capital interested in buying such property.

Geltner noted, however, that the generally positive fundamentals that currently shore up commercial property would not be immune to a severe economic downturn.

"The biggest threat would be a major recession," he said.

However, there is a more nuanced story behind the modest first-quarter uptick. The MIT/CRE publishes not only the price index based on closed deals, which rose 2.1 percent, but also compiles indices that separately track movements on the demand side and the supply side of the property market. The demand-side index tracks the changes in prices that potential buyers are willing to pay (sometimes called a "constant-liquidity" index of the market, because that is how much prices would have to change to keep a constant ability to sell as many properties at the same rate of trading volume). That index continued to fall, by 4.6 percent, the third straight quarterly drop, for a cumulative decline of more than 14 percent versus the mid-2007 peak.

But prices of closed transactions did not fall, because the supply side of the market--the property owners who are the potential sellers--actually raised the prices at which they are willing to trade, by 9.2 percent in the first quarter, according to the MIT/CRE index.

Henry Pollakowski, MIT/CRE senior economist and co-director of the Center's Commercial Real Estate Data Laboratory (CREDL), noted that the gap represents "an historically sharp disconnect" between supply and demand.

"This quarter shows the biggest pulling away of supply from demand since 1991 and the third greatest in the 96-quarter history of the index," Pollakowski said. "The result of this 'disagreement' between property owners and would-be buyers is that the volume of closed transactions tracked by the index is down drastically, falling 47 percent from the last quarter of 2007 to the first quarter of 2008."

Geltner noted that: "The results posted by our index are corroborated by recent evidence from another commercial property price index whose methodology was developed at the MIT/CRE, the Moody's/REAL Index, which showed an uptick in its latest monthly report, for February, also up 2.1 percent." The implication is that potential buyers may be influenced heavily by negative sentiment, while commercial property owners are feeling little pressure to sell and little reason to bring their prices down to levels implied by the sentiment. At some point, one side of the market or the other may "blink," and who blinks first may depend on what goes on in the broader national economy.

The TBI tracks the prices that institutions such as pension funds pay or receive when transacting properties such as shopping malls, apartment complexes and office towers. The MIT Center's TBI is based on prices of National Council of Real Estate Investment Fiduciaries (NCREIF) properties sold each quarter from the property database that underlies the NCREIF Property Index (NPI) and also makes use of the appraisal information for all of the more than 5,000 NCREIF properties. Such an index--national, quarterly, transaction-based and by property type--had not been previously constructed prior to MIT's development of it in 2006. NCREIF supported development of the index as a useful tool for research and decision-making in the industry.