HAMMEL HOLDS FORTH

Heidi Hammel, principal research scientist in the Department of Earth, Atmospheric and Planetary Sciences, provided a high-speed, color-drenched grand tour of the giant planets at a brown-bag lunch organized by the Women's League on February 8.

Dr. Hammel, whose scientific interests include cutting-edge observational techniques, has been a team leader or team member on several NASA projects, including the Hubble Space Telescope Imaging Team that studied comet Shoemaker-Levy 9's collision with Jupiter in 1994. In 1996, asteroid 1981 EC20 was renamed 3530 Hammel in her honor.

Dr. Hammel opened her presentation on the four giants (Jupiter, Saturn, Uranus and Neptune) with a view of the early practice of astronomy and comments about its shortcomings.

Pointing to a slide of primly outfitted women, notebooks in hand, clustered around a telescope, she said, "Notice those notebooks. Astronomy was subjective, due to hand-eye coordination: look through the telescope and draw what you see."

The development of the photographic plate changed astronomy into an objective and rigorous science, Dr. Hammel said. Yet, as her grand tour of the giant planets showed, now astronomers face two variables: not only is scientific equipment evolving, but so are the planets themselves.

However, human nature remains the same: we see what we want to see when we gaze heavenward.

Thus, while images from Voyager and other spacecraft embodied a great leap forward for astronomy, the very images made popular from these flights are now known to be misleading -- and misleadingly pretty.

"The dynamic colors you've grown used to seeing -- the bright red Mars for example -- are false, made up by the Voyager team to sell to the press," she said. Slides showed how the press -- the tabloid press, anyway -- used astronomical images to sell papers. One headline read: "Comet Crash Will Start U.S. Ice Age!"

Dr. Hammel contrasted Voyager images of Jupiter, Saturn, Uranus ("the Rodney Dangerfield planet") and Neptune with newer ones. She enthusiastically described her own and others' research into the changes now underway as these planets experience storm systems, comet crashes and other changes.

"My goal here was to bring you out of the Voyager era -- to show you that, for all their beauty, the Voyager pictures are just snapshots of what we will see," she said. "It's an exciting time to be a planetary astronomer."

Professor Hammel's talk was part of the "Women on the Edge of New Frontiers" series, co-sponsored by the Women's League and the Women's Forum. The next lecture in the series will be held on May 3 in the Bush Room from 1-2 pm.

Y2K PROBE UNDER WAY

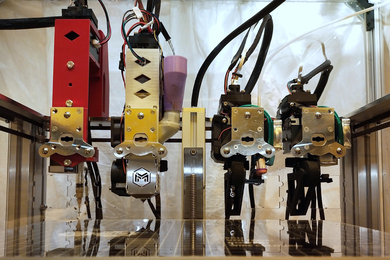

TAVA Technologies, Inc. is conducting an inventory and assessment of embedded processors to anticipate Y2K (Year 2000) risks at MIT.

Embedded chips are devices used to control, monitor or assist the operation of equipment or machinery, including laboratory devices. "Embedded" reflects the fact that they are an integral part of the system -- in many cases their presence is far from obvious to the casual observer.

Teams from TAVA, the Department of Facilities and the MIT Y2K Team began inspecting campus buildings this week. "We intend to perform this work in a manner which minimizes interference with work-in-progress," said Rocklyn Clarke, leader of the Y2K Team.

TAVA will provide an assessment of buildings and research laboratories that will identify potential equipment failure.

"In the near future, we will contact administrative officers in each department, laboratory and center to discuss this project in more detail," said Mr. Clarke. "We will ask them to obtain guides for the inspection team who have access to the spaces being inspected and who are knowledgeable about the equipment in those spaces."

The contractors will not touch, alter or open any equipment, Mr. Clarke said, but will expect their guides to have the ability to do so. The contractors will record data for subsequent analysis.

"With your assistance, we will obtain an accurate assessment that will enable us to make necessary plans to provide for continuity of operations during the Year 2000 transition," said Mr. Clarke.

For additional information, see the Y2K home page or contact the Y2K Team at y2k-help@mit.edu.

RETIREE EDUCATION GETS BOOST

The MIT Employees' Federal Credit Union has donated $5,000 to the William R. Dickson Retiree Education Fund established last year by the Quarter Century Club (QCC). The donation honors the many credit union members including Mr. Dickson, former senior vice president of MIT, who are also members of the QCC. The fund was established with an initial $100,000 Institute grant to assist retirees who are members of the QCC in pursuing educational goals after retirement from the Institute. Eligible retirees may apply for grants to reimburse them for tuition for courses or training below the graduate level.

'BULLYING TO BUYING'

Most speakers at a January 11-12 conference sponsored by the MIT Japan Program agreed that the long-term prospect of a healthy Japanese economy made it worthwhile for foreign investors to carefully evaluate new opportunities there. The title of the conference was "From Bullying to Buying: Opportunities for Foreign Investment in Japan."

Conference speakers provided many examples of change in the Japanese economy. Financial deregulation and economic reforms are forcing Japanese managers and investors to pay attention to the cost of capital and seek better returns. The need to address seriously underfunded government and private pension liabilities has brought about liberalization of the fund management business, and foreign firms have found new opportunities.

Although medium- to long-term opportunities exist, many speakers cautioned that the short-term picture is not bright and uncertainties abound. The sharp contradiction between the long-term interests of the economy and the short-term interests of politicians is a reason to worry that reforms will be derailed.

The Japanese banking system remains mired in ���100 trillion of bad debts. Several speakers agreed that a further significant fall in the equity markets is possible. David Asher, a Japan Program research fellow, warned that the reckless fiscal-stimulus and investment policies of the Japanese government are creating the conditions for a severe fiscal crisis by the end of 1999.

A version of this article appeared in MIT Tech Talk on February 24, 1999.