A private letter ruling by the IRS will allow MIT to invest certain charitable trusts with the larger university endowment.

To date, MIT, Harvard and Stanford are the only U.S. universities to be granted this permission.

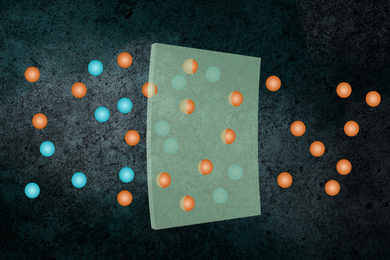

The ruling will provide the charitable remainder trusts with significant diversification and growth potential. Qualified charitable trusts can now be invested in nonmarketable securities, or "alternative assets," which form a significant portion of MIT's endowment.

These assets, including private equity, real estate, absolute return and natural resources investments, are rarely available to smaller investors.

Last year MIT's endowment earned 23 percent, the highest reported return by a major U.S. university in that period. Over the past 10 years, MIT's endowment has returned 15 percent per annum.

Charitable remainder trusts pay the donor or other named beneficiaries a fixed percentage of the fair market value annually for life. After the death of the beneficiaries, the remaining trust assets pass to MIT, to be used according to the donor's instructions.

Donors who establish such trusts also receive an income tax deduction and the opportunity to avoid capital gains tax on appreciated assets.

The IRS ruling applies to most charitable trusts set up at MIT. Donors who turn outside trusts over to MIT as its trustee and designate the entire charitable remainder for the university may also benefit.

For more information about the endowment option, contact the Office of Gift Planning at MIT at 617-253-6463.