Business executives spend a lot of time fretting over the supply chain, and for good reason. Decisions about mobile commerce and web-based logistics can make or break a company. Yet just when you think you've got a handle on it, the supply chain changes again.

"In the U.S. today, consumer products are typically manufactured offshore, brought in through a handful of ports, and then delivered through a three-tier distribution system," says Chris Caplice, executive director of MIT's Center for Transportation & Logistics (CTL). "Yet the recent trends of decentralization and digitization look like they might really disrupt this design and change the way we've been doing supply chain for 20 years. These two trends are feeding into each other, and could dramatically change the way we manufacture and distribute finished products."

The key disruptors are 3-D printing and other additive manufacturing technologies, which digitize and reproduce tangible goods. There's no reason to believe that digitization's impact on manufacturing will be any less significant than its impact on books, music, and movies. 3-D printing is already disrupting business-as-usual in the manufacturing of prosthetics and medical implants, says Caplice, who is also founder of the MIT FreightLab, a research initiative that focuses on the way freight transportation is designed, procured, and managed.

Companies are now looking to apply 3-D printing to a whole range of products. For example, UPS is piloting 3-D printing services in selected UPS Store locations, and Motorola's Project Ara aims to use the technology to build highly customized smartphones.

"For an increasing number of items, there's a growing bifurcation of the intellectual property from the physical product," Caplice says. "By digitizing a product, you can more easily customize it. Items can be manufactured layer by layer to fit an individual exactly. It's really going to tap into our desire to be different."

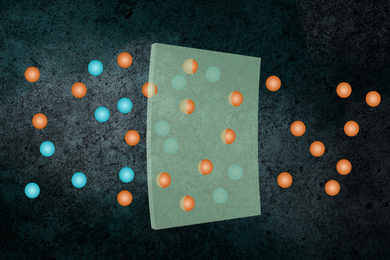

According to Caplice, the move toward customized 3-D printed products will change not only the number of stock-keeping units (SKUs) a company provides, but also the scope of inventory. "Generally, customized 3-D printing is going to increase the number of SKUs, but in the end, it could also reduce the total inventory level for certain products like spare parts," Caplice says. "If you are Cummins or Caterpillar, you have to maintain a 1940s tractor that's still out in the field, even if that spare part gets used only every 10 years. With 3-D printing, instead of keeping them in stock, you have a machine that can make them on demand. So the total quantity of inventory will go down while the number of unique items will dramatically increase."

Companies will also be motivated to decentralize manufacturing, Caplice says. "The trend toward decentralization has been spurred on by an increase of customization options toward the end of the manufacturing cycle," he says. "As demand for customization increases, the size of the main manufacturing plant can shrink. As it gets smaller, you can move it closer to points of consumption, closer to where most of the people live. This will have a significant change on distribution of goods because you won't have as much long haul — you won't have as much volume coming in through the ports."

Omni-channel retail

The changing supply-chain picture is complicated by the evolving role of the Internet in e-commerce. Not only does e-commerce represent an increasing percentage of retail sales, but with the growth of the mobile Internet, retail is evolving into an "omni-channel" approach. The trend is "changing how we handle orders and delivery," Caplice says.

Companies are beginning to integrate their online and bricks-and-mortar businesses, Caplice says, resulting in many more options for purchasing and delivering products. You can order a product on a smartphone and pick it up at the store, or you can see something you like at the store, place an order for it, and have it delivered at home.

"The blending of where you place your order and where you get it delivered is changing the way retailers set up their supply chains," Caplice says. "They're putting more inventory into their stores, which are now acting as advanced warehouses. It's hard to blend these inventories together because they don't always know where everything is. It's not isolated into these distinct channels, which is how they set up their retail chains."

CTL: A global-scale network for supply chain research

Helping companies respond to new supply chain trends like digitization, decentralization, and omni-channel retail is the central charter of the 40-year-old Center for Transportation & Logistics (CTL). In addition to master’s and PhD programs, the Center offers executive education. About 50 companies, ranging from WalMart to BASF to Procter & Gamble, send their executives to CTL to learn the latest concepts. These partner companies also recruit and collaborate with CTL students.

The CTL also does about $10 million in funded research, mainly from the private sector, Caplice says. "The projects range from resilience of supply chain to sustainable supply chains to humanitarian logistics to freight transportation and more.”

Over the last decade, one of the biggest projects has been the MIT Global Supply Chain and Logistics Excellence (SCALE) Network, which essentially duplicates CTL’s education, corporate outreach, and research programs in other countries. Centers have been set up in Zaragoza, Spain; Bogotá, Colombia; and Kuala Lumpur, Malaysia. This year more than 100 students enrolled in SCALE Network graduate programs.

Corporate interest in the SCALE Network is high, Caplice says, as it gives companies hands-on experience with how supply chain practices might differ in Europe, Latin America, and Asia. "We have partners like BASF and Ralph Lauren that are involved in all four programs to give them a larger, more global solution."

The MIT FreightLab and a world of uncertainty

Caplice founded the MIT FreightLab six years ago to research freight transportation issues, including planning, design, procurement, and management. FreightLab's Future Freight Flows project, for example, applies scenario planning and a "softer qualitative approach" to long-term planning, Caplice says. Funded in part by the U.S. Department of Transportation and various state governments, the project is developing tools and strategies to assist local governments in making long-term freight transportation investments.

Several other FreightLab projects focus on planning under uncertainty. In a project with WalMart, for example, the researchers used stochastic optimization to "determine when to use a private fleet or a for-hire carrier for selected lanes, depending on the variability of demand within their stores," Caplice says.

A separate FreightLab project with the Defense Department's U.S. Transportation Command is "looking at the frontier between being robust and being flexible," Caplice says. "How much effort should you put into building a very resilient plan that won't break versus having something that's more flexible with real-time operations?" Procurement has been another major research focus. "The takeaway is that the method of procurement should match the economics of the underlying vendor," Caplice says.

In the end, freight planning always comes down to risk management, which can be complicated by wild cards like fluctuating energy prices and increasingly unstable weather. "Whenever you're doing a planning model for supply chain and logistics, you always want to watch out for where the uncertainties lie," Caplice says. "There can be uncertainty of demand, of input, of fuel prices, or of resource availability. Every domain has a different set of uncertainties, so you can't have a cookie-cutter approach. You have to understand the uncertainties affecting that business and then model and plan around them."

"In the U.S. today, consumer products are typically manufactured offshore, brought in through a handful of ports, and then delivered through a three-tier distribution system," says Chris Caplice, executive director of MIT's Center for Transportation & Logistics (CTL). "Yet the recent trends of decentralization and digitization look like they might really disrupt this design and change the way we've been doing supply chain for 20 years. These two trends are feeding into each other, and could dramatically change the way we manufacture and distribute finished products."

The key disruptors are 3-D printing and other additive manufacturing technologies, which digitize and reproduce tangible goods. There's no reason to believe that digitization's impact on manufacturing will be any less significant than its impact on books, music, and movies. 3-D printing is already disrupting business-as-usual in the manufacturing of prosthetics and medical implants, says Caplice, who is also founder of the MIT FreightLab, a research initiative that focuses on the way freight transportation is designed, procured, and managed.

Companies are now looking to apply 3-D printing to a whole range of products. For example, UPS is piloting 3-D printing services in selected UPS Store locations, and Motorola's Project Ara aims to use the technology to build highly customized smartphones.

"For an increasing number of items, there's a growing bifurcation of the intellectual property from the physical product," Caplice says. "By digitizing a product, you can more easily customize it. Items can be manufactured layer by layer to fit an individual exactly. It's really going to tap into our desire to be different."

According to Caplice, the move toward customized 3-D printed products will change not only the number of stock-keeping units (SKUs) a company provides, but also the scope of inventory. "Generally, customized 3-D printing is going to increase the number of SKUs, but in the end, it could also reduce the total inventory level for certain products like spare parts," Caplice says. "If you are Cummins or Caterpillar, you have to maintain a 1940s tractor that's still out in the field, even if that spare part gets used only every 10 years. With 3-D printing, instead of keeping them in stock, you have a machine that can make them on demand. So the total quantity of inventory will go down while the number of unique items will dramatically increase."

Companies will also be motivated to decentralize manufacturing, Caplice says. "The trend toward decentralization has been spurred on by an increase of customization options toward the end of the manufacturing cycle," he says. "As demand for customization increases, the size of the main manufacturing plant can shrink. As it gets smaller, you can move it closer to points of consumption, closer to where most of the people live. This will have a significant change on distribution of goods because you won't have as much long haul — you won't have as much volume coming in through the ports."

Omni-channel retail

The changing supply-chain picture is complicated by the evolving role of the Internet in e-commerce. Not only does e-commerce represent an increasing percentage of retail sales, but with the growth of the mobile Internet, retail is evolving into an "omni-channel" approach. The trend is "changing how we handle orders and delivery," Caplice says.

Companies are beginning to integrate their online and bricks-and-mortar businesses, Caplice says, resulting in many more options for purchasing and delivering products. You can order a product on a smartphone and pick it up at the store, or you can see something you like at the store, place an order for it, and have it delivered at home.

"The blending of where you place your order and where you get it delivered is changing the way retailers set up their supply chains," Caplice says. "They're putting more inventory into their stores, which are now acting as advanced warehouses. It's hard to blend these inventories together because they don't always know where everything is. It's not isolated into these distinct channels, which is how they set up their retail chains."

CTL: A global-scale network for supply chain research

Helping companies respond to new supply chain trends like digitization, decentralization, and omni-channel retail is the central charter of the 40-year-old Center for Transportation & Logistics (CTL). In addition to master’s and PhD programs, the Center offers executive education. About 50 companies, ranging from WalMart to BASF to Procter & Gamble, send their executives to CTL to learn the latest concepts. These partner companies also recruit and collaborate with CTL students.

The CTL also does about $10 million in funded research, mainly from the private sector, Caplice says. "The projects range from resilience of supply chain to sustainable supply chains to humanitarian logistics to freight transportation and more.”

Over the last decade, one of the biggest projects has been the MIT Global Supply Chain and Logistics Excellence (SCALE) Network, which essentially duplicates CTL’s education, corporate outreach, and research programs in other countries. Centers have been set up in Zaragoza, Spain; Bogotá, Colombia; and Kuala Lumpur, Malaysia. This year more than 100 students enrolled in SCALE Network graduate programs.

Corporate interest in the SCALE Network is high, Caplice says, as it gives companies hands-on experience with how supply chain practices might differ in Europe, Latin America, and Asia. "We have partners like BASF and Ralph Lauren that are involved in all four programs to give them a larger, more global solution."

The MIT FreightLab and a world of uncertainty

Caplice founded the MIT FreightLab six years ago to research freight transportation issues, including planning, design, procurement, and management. FreightLab's Future Freight Flows project, for example, applies scenario planning and a "softer qualitative approach" to long-term planning, Caplice says. Funded in part by the U.S. Department of Transportation and various state governments, the project is developing tools and strategies to assist local governments in making long-term freight transportation investments.

Several other FreightLab projects focus on planning under uncertainty. In a project with WalMart, for example, the researchers used stochastic optimization to "determine when to use a private fleet or a for-hire carrier for selected lanes, depending on the variability of demand within their stores," Caplice says.

A separate FreightLab project with the Defense Department's U.S. Transportation Command is "looking at the frontier between being robust and being flexible," Caplice says. "How much effort should you put into building a very resilient plan that won't break versus having something that's more flexible with real-time operations?" Procurement has been another major research focus. "The takeaway is that the method of procurement should match the economics of the underlying vendor," Caplice says.

In the end, freight planning always comes down to risk management, which can be complicated by wild cards like fluctuating energy prices and increasingly unstable weather. "Whenever you're doing a planning model for supply chain and logistics, you always want to watch out for where the uncertainties lie," Caplice says. "There can be uncertainty of demand, of input, of fuel prices, or of resource availability. Every domain has a different set of uncertainties, so you can't have a cookie-cutter approach. You have to understand the uncertainties affecting that business and then model and plan around them."